Over the next few pages, we’ll dig into the trends reported by health club respondents to the Industry Report survey, which includes health, sports and fitness clubs, racquet clubs and medical fitness facilities. These respondents made up 6.5% of the survey population in 2023.

In a departure from the rest of the survey audience, respondents from health clubs were most likely to be located in the South or the West of the U.S. Some 23.3% of health club respondents said they were located in the South Atlantic region, while 21.7% were located in the South Central region, and 21.7% were located in the West. Another 18.3% of health club respondents said they called the Northeast home, and 15% were located in the Midwest.

More than half (55%) of health club respondents said they were located in suburban communities, with a little more than a quarter (26.7%) reporting from urban areas. Another 18.3% were located in rural communities.

On average, health club respondents are reaching an audience of 16,680 people. The median population size for health clubs in 2023 is 1,000 people.

Health club respondents were most likely to work for private, rather than public or governmental, organizations. The largest number—59.7%—said they were with private, for-profit facilities. Another 27.3% were with private, nonprofit facilities. And just 13% said they were with public organizations.

On average, health club respondents in 2023 said they manage 3.6 individual facilities, up from 1.7 in 2022 and 2.9 in 2021. The vast majority—86.6%—of health club respondents manage between one and three individual facilities. Some 63.3% said they manage just a single facility, and 23.3% manage two to three facilities. This compares with 33.9% and 19.4% of non-health-club respondents, respectively. Another 6.7% of health club respondents said they manage between four and nine individual facilities, and 8.3% manage 10 or more  facilities.

facilities.

Health club respondents in 2023 were much more likely than those in 2022 to report that they form partnerships with other organizations. Nearly three-quarters (73.3%) of health club respondents in 2023 said they form partnerships, up from 62.5% in 2022. This compares with 85.2% of non-health-club respondents. The most common partners for health clubs were health care and medical facilities. More than one-third (36.6%) of health club respondents said they had partnered with medical facilities, compared with 20.1% of non-health-club respondents. The next most common partners for health club respondents were: corporations and local businesses (30.7% of health club respondents had partnered with businesses); local schools (25.3%); nonprofit organizations (20%); and colleges and universities (14.7%).

Health club respondents were much more likely than others to report that their primary audience consists of adults. Some 63.6% of health club respondents said that adults were their primary audience, compared with just 15.1% of non-health-club respondents. And while just 7.8% of health club respondents said seniors were their primary audience, that still made them more than twice as likely as other respondents to primarily serve seniors, as just 3.5% of non-health-club respondents’ primary audience was made up of seniors. Another 22.1% of health club respondents said they primarily reach all ages, while 3.9% work with children ages 4 to 12. Another 1.3% primarily reach teenagers from 13 to 18 years old, and 1.3% primarily reach college students.

Revenues & Expenditures

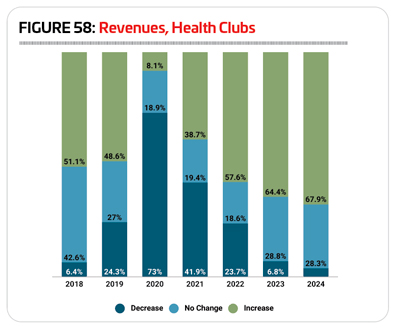

Health club respondents’ revenues were dramatically affected by the closures of the coronavirus pandemic, with the most major impact felt in 2020, then lingering through much of 2021. In 2020, nearly three-quarters (73%) of health club respondents saw their revenues drop, and in 2021, 41.9% reported a decrease in revenues. In 2022, the business picture began to look rosier for health club respondents, and while nearly a quarter (23.7%) still saw decreasing year-over-year revenues, well over half (57.6%) saw their revenues increase in 2022, and another 18.6% reported no change. (See Figure 58.)

Looking forward, health club respondents were optimistic, as is generally the case. Around two-thirds expect their revenues to increase in 2023 (64.4%) and in 2024 (67.9%). At the same time, the number of health club respondents who are anticipating declining revenues falls to 6.8% in 2023 and 3.8% in 2024.

In 2023, health club respondents spent an average of $1,296,000 on their operating expenses. The highest reported annual operating cost was $6 million, and the median was just $386,000.

Looking forward, health club respondents projected a 9.3% increase to their average operating cost from 2022 to 2023, with the average cost rising to $1,417,000. But in 2024, health club respondents reported an average that is 25% lower than the average for 2022— $968,000.

While the largest number of health club respondents (35.7%) did not know their cost recovery rate, the next largest numbers earned back much higher percentages of their operating costs via revenues than other respondents, reflecting their largely for-profit nature. Some 21.4% of health club respondents said they earned back 80% or more of their operating costs via revenues, compared with just 7.8% of non-health-club respondents. And while nearly one-third (32.1%) of health club respondents earned back between 61% and 80% of their operating costs via revenues, just 15.5% of non-health-club respondents earned between 61% and 80%. Another 7.1% of health club respondents said they earned back 21% to 40% of their operating costs via revenues, and just 3.6% said they earned back 20% or less.

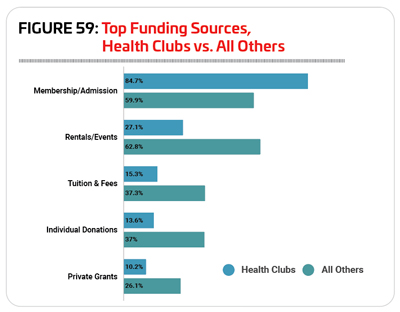

When it comes to the sources of funding for their facilities, it comes as no surprise that health club respondents overwhelmingly rely on membership fees. This was the only revenue source that was more common for health club respondents than for other respondents. Some 84.7% of health club respondents named membership and admission fees as a source of funding for their facilities, compared with 59.9% of all other respondents. The next most common source of funding for health club respondents, in a distant second place, was facility rentals and private events, which 27.1% of health club respondents said was a source of funding for their facilities. (See Figure 59.)

Fewer health club respondents in 2023 said they had taken action over the past several years to reduce their operating costs. Some 80.4% of health club respondents in 2023 said they had done so, down from 86.7% in 2022 and 91.9% in 2021. This compares with 83.5% of non-health-club respondents in 2023 who said they had taken action to reduce their operating costs.

The most common measure health club respondents relied on to reduce their costs was increasing their fees. Nearly half (48.2%) of health club respondents in 2023 said they had increased their fees. Another 44.6% said they had reduced staff, while 41.1% had reduced their hours of operation. At least a quarter had also cut programming and services (28.6%) or improved energy efficiency (25%) in order to reduce their operating expenditures.

Health Club Facilities

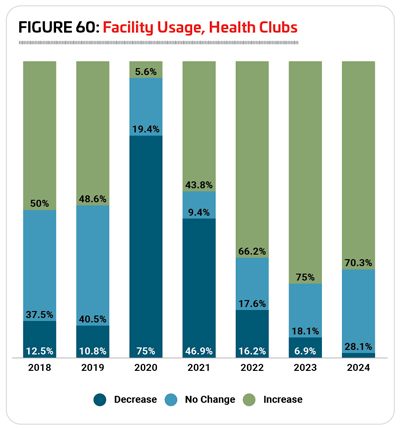

Given their largely for-profit nature and the fact that they are primarily funded through fees for users, it comes as no surprise that the graph showing the number of people using facilities almost mirrors the graph showing facility revenues. The pandemic impact is again reflected in the years 2020 and 2021, with 75% of health club respondents reporting a drop in visitors in 2020 and 46.9% reporting a decrease in 2021. The year 2022 showed things getting back to business as usual: Two-thirds (66.2%) of health club respondents said the number of people using their facilities increased in 2022, while 17.6% reported no change and 16.2% saw a decrease. (See Figure 60.)

Looking forward, health club respondents were optimistic, expecting usage of their facilities to increase in 2023 (75% of health club respondents expect usage to increase in 2023) and in 2024 (70.3%). Another 18.1% of health club respondents are expecting to see no change in 2023, while 6.9% are anticipating a decrease to the number of people using their facilities. And in 2024, 28.1% expect the number of people using their facilities to remain unchanged, while just 1.6% are anticipating a decline.

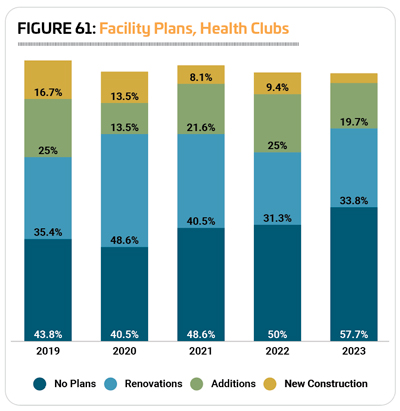

Health club respondents were again the least likely to be planning construction in 2023, with just 42.3% indicating they have plans for any kind of construction over the next few years. This is down from 50% in 2022, and compares with two-thirds (66.6%) of non-health-club respondents in 2023 who have plans for construction. Health club respondents were most likely to be planning renovations to their existing facilities, with a little more than a third (33.8%) indicating they had plans for renovations (up from 31.3%). Another 19.7% of health club respondents were planning additions to their existing facilities (down from 25%), and just 4.2% were planning new construction, down from 9.4% in 2022. (See Figure 61.)

Health club respondents in 2023 were planning to spend an average of $1,158,000 on their construction plans. The highest planned construction budget was $10 million, and the median was $250,000.

The features most commonly included among health club respondents’ facilities in 2023 include: fitness centers; exercise studio rooms; locker rooms; Wi-Fi, indoor courts for sports like basketball and volleyball; classrooms and meeting rooms; indoor aquatic facilities; childcare centers; concession areas; and playgrounds.

As is usually the case, health club respondents were far less likely than their peers from other facilities to report that they had plans to add features at their facilities over the next few years. Some 19.5% of health club respondents in 2023 said they would be adding features at their facilities, up from 18.8% in 2022, but still below the 21.6% who had such plans in 2021. This compares with 48.5% of non-health-club respondents in 2023 (and 40.3% in 2022) who had plans to add features at their facilities.

The 10 most commonly planned features for health club respondents include:

1. Playgrounds (33.3% of health club respondents with plans to add features will be adding playgrounds)

2. Synthetic turf sports fields (33.3%)

3. Classrooms and meeting rooms (33.3%)

4. Outdoor sports courts (26.7%)

5. Indoor sports courts (26.7%)

6. Splash play areas (26.7%)

7. Concession areas (26.7%)

8. Natural turf sports fields (20%)

9. Indoor aquatic facilities (20%)

10. Indoor walking and running tracks (20%)

Programming

Creative and engaging programming, from fitness classes to personal training, is essential to most health club operations, driving new memberships and keeping existing members coming back to the facility again and again. And indeed, 98.6% of health club respondents in 2023 said they provide programming of any kind at their facilities, down from 100% in 2022.

The 10 types of programming most commonly offered by health club respondents’ facilities in 2023 include: fitness programs (provided by 87.7% of health club respondents); group exercise programs (76.7%); functional fitness programs (75.3%); personal training (75.3%); mind-body balance programs such as yoga (57.5%); programs for active older adults (50.7%); nutrition and diet counseling (49.3%); holidays and other special events (46.6%): educational programs (32.9%); and aquatic exercise programs (30.1%).

Programs that saw growth from 2022 to 2023 include: programs for active older adults (up 13.2 percentage points, from 37.5% in 2022); holidays and special events (up 12.2 points, from 34.4%); and group exercise programs (up 1.7 points, from 75%).

Some 31.1% of health club respondents in 2023 said they had plans to add programs at their facilities over the next few years. This is up from 21.9% in 2022, but below the 32.4% reported in 2021, and compares with 42.2% of non-health-club respondents in 2023 who said they had plans to add programs at their facilities.

The most commonly planned program additions for health clubs in 2023 include:

1. Mind-body balance programs such as yoga (no change from 2022)

2. Teen programming (was not among the top planned programs for 2022)

3. Sport training such as tennis lessons (did not appear in 2022)

4. Group exercise programs (up from No. 10)

5. Fitness programs (down from No. 3)

6. Special needs programs (no change from 2022)

7. Adult sports teams (did not appear in 2022)

8. Individual sports activities like swimming and running clubs (no change from 2022)

9. Sports tournaments and races (did not appear in 2022)

10. Aquatic exercise programs (did not appear in 2022)

Several programs rose into the top 10, including teen programming, sport training, adult sports teams, sports tournaments and races, and aquatic exercise programs. They replaced swimming programs, functional fitness programs, programs for active older adults, nutrition and diet counseling, and therapeutic programs.

Top Issues

Asked about the top challenges and concerns for their facilities, health club respondents were most likely to name staffing issues as a top concern. Half (50%) of health club respondents said staffing was a top concern, down from 51.6% in 2022). This compares with 50.8% of non-health-club respondents who said staffing was a top concern. Another 32.8% of health club respondents said equipment and facility maintenance were a top concern (compared with 42% of non-health-club respondents) or that marketing and increasing participation was a top concern (compared with 17.5% of non-health club respondents). Health club respondents were much more likely than other respondents to feel that fitness and wellness are a top concern. Some 29.3% of health club respondents named general fitness and wellness as a top concern, compared with 13.2% of non-health-club respondents, and 22.4% of health club respondents were concerned about fitness and wellness for older adults, versus just 8.7% of non-health-club respondents. RM