In these pages, we’ll examine the responses to the Industry Report survey from health club respondents. Making up 5% of the survey population in 2024, this group includes those working for health clubs, sports clubs, fitness clubs, racquet clubs and medical fitness facilities.

Unlike much of the survey audience, respondents from health clubs were most likely to be located in the South Central region of the U.S. Some 28.6% of health club respondents said they called the South Central states home. Another 20% were located in the Northeast, and 20% were also located in the Western states. Some 17.1% of health club respondents were from the Midwest region, and 11.4% were from the South Atlantic states.

More than six out of 10 (62.9%) health club respondents said they were located in suburban communities, with nearly a quarter (22.9%) reporting in from rural areas. Another 14.3% of health club respondents said they were located in urban communities.

On average, health club respondents said their facilities serve 14,900 people per year. The median audience size for health clubs in 2024 is 1,650 people.

Around two-thirds (67.2%) of health club respondents said they worked for private, for-profit facilities. Another fifth (20.4%) worked for private nonprofit facilities. And just 12.2% said they worked for public organizations.

(20.4%) worked for private nonprofit facilities. And just 12.2% said they worked for public organizations.

On average, health club respondents in 2024 said they manage 3.1 individual facilities, similar to last year’s response, which was 3.6. More than six in 10 (63.9%) health club respondents said they manage just a single facility, compared to 28.4% of non-health-club respondents. Another 22.2% of health club respondent said they manage between two and three facilities. Some 11.2% manage between four and nine facilities. And just 2.8% manage more than 10 individual facilities.

Health club respondents in 2024 were among those least likely to report that they had formed partnerships with other organizations. While more than half (52.6%) had formed such partnerships, that compares with 87.2% of all other respondents.

The most common partners in 2024 for health club respondents were corporations and local businesses. Some 36.8% of health club respondents said they had partnered with businesses. Health care and medical facilities were the second most common partner with nearly a third (31.6%) of health club respondents indicating they had partnered with them. The other most common partners for health clubs were local schools (18.4% of health club respondents had partnered with local schools), nonprofit organizations (18.4%) and local government (15.8%).

Health club respondents were among the most likely to report that the primary audience for their facility is made up of adults. Some 56.1% of health club respondents said adults are their primary audience, compared with 14.6% of non-health-club respondents. Another 34.1% of health club respondents said they primarily reach all ages. And 9.8% of health club respondents’ primary audience is made up of seniors.

Revenues & Expenditures

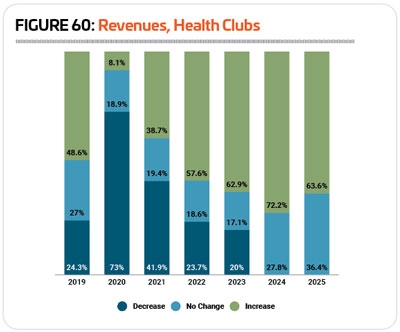

The impact of the pandemic on health clubs is well known, with closures and social distancing having a dramatic impact. And in fact, in 2020, nearly three-quarters (73%) of health club respondents reported a decrease in their revenues. The situation gradually improved through 2021 and 2022, and in 2023, more than six in 10 (62.9%) health club respondents reported that their revenues were higher, year-over-year, with 17.1% reporting no change and 20% reporting a decrease. (See Figure 60.)

In 2024 and 2025, health club respondents are very positive, with none expecting revenues to decrease. In 2024, 72.2% of health club respondents are anticipating increasing revenues, while 27.8% expect no change. And in 2025, 63.6% expect to see revenues increase, while 36.4% are anticipating no change.

of health club respondents are anticipating increasing revenues, while 27.8% expect no change. And in 2025, 63.6% expect to see revenues increase, while 36.4% are anticipating no change.

In 2024, health club respondents spent an average of $655,000 on their operating expenses. The highest reported annual operating cost was $3.1 million, and the median was just $327,500.

Looking forward, health club respondents expect their operating costs to increase, with a 34.2% increase between 2023 and 2025, to an average of $879,000 in 2025.

On average, health club respondents recover 85.7% of their operating costs via revenue. The highest reported cost recovery rate was 100%, and the lowest was 36%. The median cost recovery rate was 99%, which means far more health club respondents are recovering a greater share of their costs via revenue.

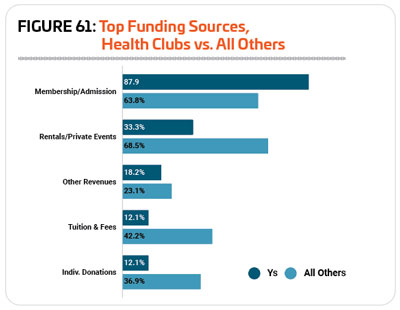

Health club respondents’ facilities are overwhelmingly supported by fees for membership and admission. In fact, 87.9% of health club respondents said they received funds from membership and admission, making this the only revenue source that was more common for health club respondents than for others. Some 63.8% of non-health-club respondents received funding via membership and admission. The next most common sources of funding for health club facilities was rentals and private events, which 33.3% of health club respondents named as a funding source, followed by other undefined revenues, a source of funding for 18.2% of health club respondents. (See Figure 61.)

The number of health club respondents who indicated that they had taken action over the past few years to reduce their operating costs fell more than 10 percentage points between 2023 and 2024. In 2023, 80.4% of health club respondents had done so, while 69.7% in 2024 had taken such action. This compares with 84% of non-health-club respondents in 2024 who said they had taken action to reduce their operating costs.

The most common measure health club respondents turned to in order to reduce their costs was improving energy efficiency. Some 39.4% of health club respondents said they had improved energy efficiency at their facilities in order to reduce their costs. Another 33.3% said they had increased fees, 21.2% had reduced staff, 18.2% had put construction or renovation plans on hold, and 15.2% said they had cut programs or services at their facilities.

Buildings & Amenities

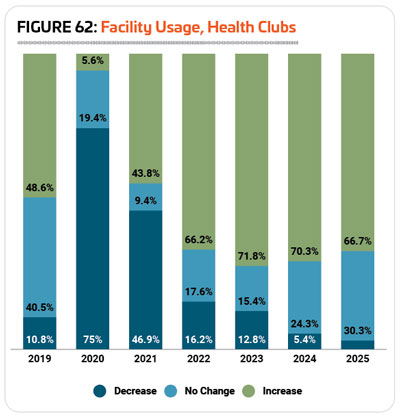

As with their revenues, health club respondents had a great 2023 in terms of facility usage, with 71.8% reporting that the number of people using their facilities increased over 2022. Another 15.4% said there was no change in the number of people using their facilities, and 12.8% reported a decrease. (See Figure 62.)

Health club respondents are also very positive about the next two years, with 70.3% expecting an increase in the number of people using their facilities in 2024, and 66.7% anticipating an increase in 2025. Just 5.4% expect a decrease in 2024, and 3% expect a decrease in 2025.

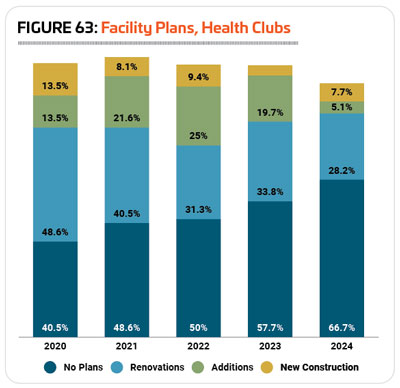

Health club respondents in 2024 were once more the least likely to be planning construction of any kind over the next few years, with just a third (33.3%) indicating they had plans for construction. This is down from 42.3% in 2023 and 50% in 2022.

Health club respondents were most likely to be planning renovations to their existing facilities, with 28.2% indicating they had renovation plans, down from 33.8%. Another 5.1% of health club respondents were planning additions to their existing facilities (down from 19.7%), and 7.7% were planning new construction, up from 4.2% in 2023. (See Figure 63.)

In 2024, health club respondents were planning to spend an average of $302,000 on their construction plans. The highest planned construction budget was $600,000, and the median was $300,000.

The features most commonly included among health club respondents’ facilities in 2024 include: fitness centers, exercise studio rooms, locker rooms, Wi-Fi services, indoor aquatic centers, classrooms and meeting rooms, indoor courts for sports like basketball and volleyball, childcare centers, community or multipurpose centers, and concession areas.

As always, health club respondents were much less likely than respondents from other types of facilities to indicate they were planning to add any new features at their facilities over the next few years. Some 14.9% of health club respondents in 2024 said they would be adding amenities at their facilities, down from 19.5% in 2023 and 18.8% in 2022. This compares with 48.7% of non-health-club respondents in 2024 (and 48.5% in 2023) who had plans to add features at their facilities.

The most commonly planned features for health club respondents include:

1. Fitness trails and outdoor fitness equipment (28.6% of health club respondents with plans to add features)

2. Synthetic turf sports fields (28.6%)

3. Splash play areas (14.3%)

4. Playgrounds (14.3%)

5. Outdoor sports courts (14.3%)

6. Indoor sports courts (14.3%)

7. Fitness centers (14.3%)

8. Locker rooms (14.3%)

9. Concession areas (14.3%)

10. Climbing walls (14.3%)

Programming

While many health club members are content to head to the cardio floor or weight room to get a workout in, group  exercise programs and other programming can help create a more social atmosphere, keeping members coming back for more. Some 92.5% of health club respondents in 2024 said they provide programming of any kind at their facilities, down from 98.6% in 2023.

exercise programs and other programming can help create a more social atmosphere, keeping members coming back for more. Some 92.5% of health club respondents in 2024 said they provide programming of any kind at their facilities, down from 98.6% in 2023.

The 10 types of programs most commonly seen in health club respondents’ facilities in 2024 include: fitness programs (provided by 82.9% of health club respondents), group exercise programs (78.4%), personal training (75.7%), functional fitness programs (70.3%), mind-body balance programs such as yoga and tai chi (54.1%), programs for active older adults (48.6%), nutrition and diet counseling (48.6%), holiday events and other special events (43.2%), aquatic exercise programs (37.8%), and swimming programs (27%).

One-quarter (25%) of health club respondents in 2024 said they had plans to add programs at their facilities over the next few years. This is down from 31.1% in 2023, but still higher than the 21.9% who had such plans in 2022.

The most commonly planned program additions for health clubs in 2024 include:

1. Mind-body balance programs such as yoga (no change from 2023)

2. Sport training such as tennis lessons or golf instruction (up from No. 2)

3. Nutrition and diet counseling (did not appear among top planned programs in 2023)

4. Sports tournaments and races (up from No. 9)

5. Environmental education programs (did not appear in 2023)

6. Teen programming (down from No. 2)

7. Holiday events and other special events (did not appear in 2023)

8. Adult sports teams (down from No. 7)

9. Programs for active older adults (did not appear in 2023)

10. Group exercise programs (down from No. 4)

As usual, there were new programs in the top planned programs list that did not appear in last year’s top 10, including nutrition and diet counseling, environmental education programs, holiday events and other special events and programs for active older adults. They replace fitness programs, special needs programs, individual sports activities and aquatic exercise programs from 2023’s list of top planned programs.

Top Challenges

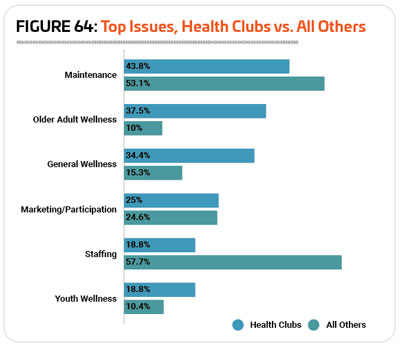

When asked about what they considered to be the top issues for their facilities currently, health club respondents were much more likely to name fitness and wellness-related issues as top issues, while being less likely than others to be concerned about staffing, though staffing was still among their top issues.

The No. 1 issue of concern for health club respondents in 2024 was equipment and facility maintenance, cited by 43.8% as a top issue. However, non-health-club respondents were more likely to be concerned about maintenance issues, with 53.1% naming it a top concern.

Health club respondents were much more likely than others to be concerned about fitness and wellness for older adults (37.5% vs. 10% of non-health-club respondents), general fitness and wellness (34.4% vs. 15.3%) and youth fitness and wellness (18.8% vs. 10.4%). (See Figure 64.) RM