Whether you’re operating a series of neighborhood splash pads, a high school natatorium, a community pool, or a destination waterpark, you know that aquatic facilities vary widely. While many facility challenges are industry-wide issues—finding adequate staff, dealing with increasing costs, maintaining aging equipment—each individual aquatic facility comes with its own set of challenges needing attention. Aquatic facility operators and directors come to the table with a range of expertise, as well, and tapping their knowledge of their facilities—and the industry—can provide helpful benchmarks.

Here, we’re taking a deep dive into the aquatic operations, budgets, equipment and trends revealed by the results of our annual Aquatic Trends Survey. For the most part, we’ll take a broad view, looking at the responses of more than 500 aquatic industry professionals who completed the survey. Where appropriate, we’ll dig deeper into the data to provide insights on specific cohorts, including those from certain facility types (i.e., parks, colleges, Ys) or from those whose facilities include only indoor or only outdoor pools.

Here, we’re taking a deep dive into the aquatic operations, budgets, equipment and trends revealed by the results of our annual Aquatic Trends Survey. For the most part, we’ll take a broad view, looking at the responses of more than 500 aquatic industry professionals who completed the survey. Where appropriate, we’ll dig deeper into the data to provide insights on specific cohorts, including those from certain facility types (i.e., parks, colleges, Ys) or from those whose facilities include only indoor or only outdoor pools.

We’ll get started with a rundown of some of the demographic characteristics of the 502 individual aquatic professionals who responded to the survey.

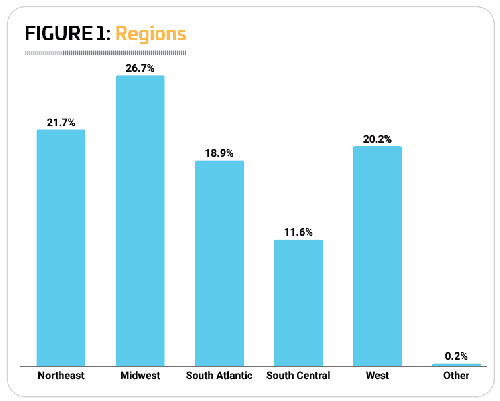

Respondents to the survey are managing aquatic facilities in all parts of the U.S., with the largest group of respondents—26.7%—hailing from the Midwest. This includes Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin. (See Figure 1.)

Another 21.7% of respondents were from the Northeast, including Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont.

Just slightly fewer respondents—20.2%—were from the Western states, which include Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming.

Again, slightly fewer respondents—18.9%—were from the South Atlantic region, which includes Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, Washington, D.C., and West Virginia.

The smallest number of U.S. respondents—11.6%—reported from the South Central region. This includes Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, Tennessee, and Texas. A single respondent (0.2%) was located outside of the U.S.

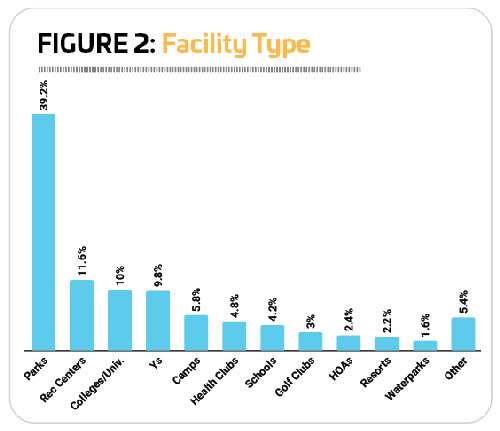

While respondents were relatively dispersed geographically, some types of facilities—especially parks and recreation departments and districts—are much more heavily represented than others. Some 39.2% of respondents said they worked for parks and rec organizations. Around one in 10 respondents represented community or private recreation and sports centers (11.6%), colleges and universities (10%), or YMCAs, YWCAs, JCCs and Boys & Girls Clubs (9.8%). Smaller numbers of respondents were with private or youth camps, campgrounds and RV parks (5.8%), sports, health and fitness clubs, racquet clubs, and medical fitness facilities (4.8%), schools and school districts (4.2%), golf clubs and country clubs (3%), homeowners’ associations (2.4%), resorts and resort hotels (2.2%), and waterparks (1.6%). Another 5.4% represented other types of organizations, including military installations, and churches. (See Figure 2.)

(Where we consider data in terms of the type of organization in the following pages, we’ll be looking at parks, colleges, Ys, rec centers, camps, health clubs and schools.)

Fifty-some years ago, the aquatics landscape was heavily dominated by rectangular outdoor pools, with occasional natatoriums and just a handful of waterparks across the country. These days, aquatic facility types are far more varied in design and capabilities, from community pools that might feature a slide and a splash play area to natatoriums built to accommodate competitive swimming and diving alongside fitness and recreational activities. We asked respondents about the different types of aquatic facilities they managed, including outdoor swimming pools, indoor swimming pools, hot tubs, aquatic parks (with a primary focus on pools, but featuring additional aquatic attractions), and waterparks (with a primary focus on waterslides and rides).

Fifty-some years ago, the aquatics landscape was heavily dominated by rectangular outdoor pools, with occasional natatoriums and just a handful of waterparks across the country. These days, aquatic facility types are far more varied in design and capabilities, from community pools that might feature a slide and a splash play area to natatoriums built to accommodate competitive swimming and diving alongside fitness and recreational activities. We asked respondents about the different types of aquatic facilities they managed, including outdoor swimming pools, indoor swimming pools, hot tubs, aquatic parks (with a primary focus on pools, but featuring additional aquatic attractions), and waterparks (with a primary focus on waterslides and rides).

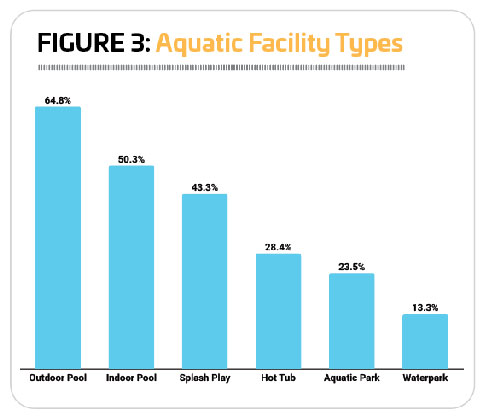

Outdoor swimming pools were the most common type of aquatic facility, as usual, with 64.8% of respondents indicating they had at least one outdoor pool, up from 62.1% in 2024’s report. Some 14% of respondents had at least four separate outdoor pool facilities, up from 10.3%. More than half (50.3%) of respondents in 2025 indicated that they had at least one indoor pool. This is down from 54.8% in 2024 and 55.2% in 2023. Splash play areas were also a common facility type, with 43.3% of respondents indicating they had at least one splash play facility. (See Figure 3.)

Aquatic parks and waterparks were less common, with 23.5% and 13.3% of respondents, respectively, reporting that they have one of these types of facilities. This represents very little change from 2024, when 24.8% of respondents had an aquatic park and 13.5% had a waterpark.

Around one in three (28.4%) respondents said they had a hot tub, spa or whirlpool, down from 31.4% in 2024.

Respondents from camp facilities were the most likely to report that they had at least one outdoor pool. In fact, 100% of camp facilities covered by the report had an outdoor pool. They were followed by parks, where 75.2% of respondents had at least one outdoor pool, and rec centers, where around two-thirds (66.1%) had at least one outdoor pool.

Indoor pools were most common for schools, Ys and colleges, with a substantial majority of respondents in each of these categories indicating that they had at least one indoor pool. This includes 90.5% of school respondents, 89.8% of Y respondents, and 78% of college respondents.

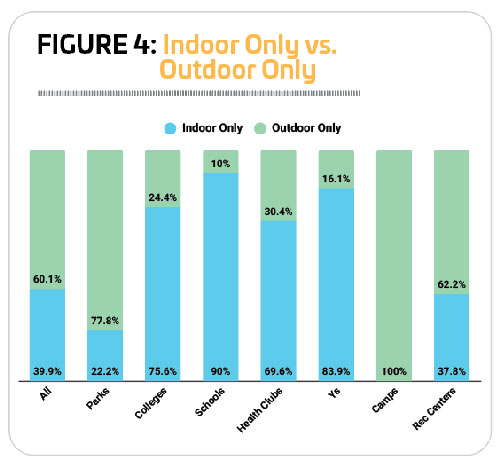

Some 71.6% of all respondents reported that their facilities were indoor-only or outdoor-only. Of these respondents, 60.1% had outdoor-only pools, while 39.9% had indoor-only pools. Respondents from camps, parks, and rec centers were much more likely to have outdoor-only pools than indoor facilities, while health clubs, colleges, Ys, and schools were much more likely to have indoor-only facilities, as opposed to outdoor pools. (See Figure 4.)

Respondents from parks were by far the most likely to have splash play areas. More than two-thirds (67.3%) of parks respondents said they currently had at least one splash play area. While this is down slightly from the 2024 report, when 68.1% of park respondents had a splash play area, it is still substantially higher than in 2023, when 61.2% of park respondents offered splash play. Rec centers were the next most likely in 2025 to include splash play, though only a little more than one-third (35.6%) of these respondents indicated that splash play could be found among their facilities.

As one might suppose, based on the typical operations of such facilities, health clubs, Ys, and rec centers were the most likely to include hot tubs, spas and whirlpools at their facilities. Some 59.3% of respondents from health clubs, 40.8% from Ys, and 37.3% from rec centers said they currently had a hot tub. (By contrast, only 4.4% of camp respondents had a hot tub.)

The less common aquatic types—aquatic parks and waterparks—were most likely to be found among parks’ and rec centers’ facilities. Around one-third (32.7%) of park respondents said they currently had an aquatic park, while 15.9% said they had a waterpark. Slightly fewer rec center respondents—32.2% and 13.6%, respectively—reported the same.

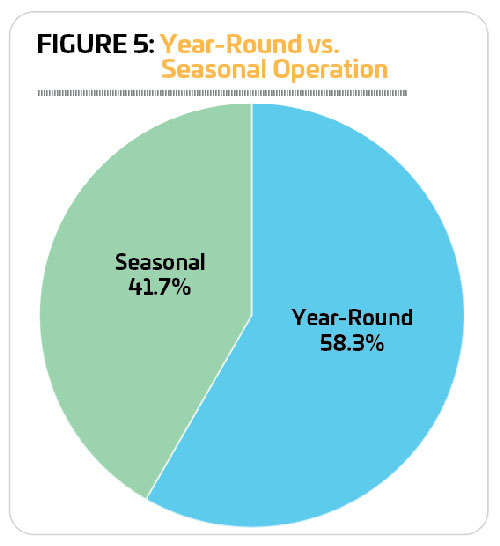

The number of respondents whose aquatic facilities are open all year has fallen somewhat over the past few years, from 61.2% in 2022 to 58.3% in 2024, while the number with seasonal operations has grown from 38.8% to 41.7% in the same period. (See Figure 5.)

The number of respondents whose aquatic facilities are open all year has fallen somewhat over the past few years, from 61.2% in 2022 to 58.3% in 2024, while the number with seasonal operations has grown from 38.8% to 41.7% in the same period. (See Figure 5.)

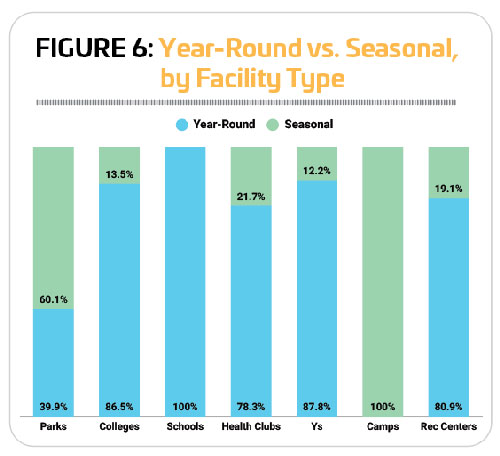

The picture of facilities with year-round vs. seasonal operations is very similar to that of those with outdoor-only vs. indoor-only pools, for obvious reasons, with camps most likely to have seasonal operations (100% of them, in fact), and schools most likely to have year-round operations (again, 100%). Besides camps, seasonal operations were most common for respondents from parks, where 60.1% of respondents operated their aquatic facilities seasonally. After schools, year-round aquatic operations were most common for respondents from Ys (87.8%), colleges (86.5%) and rec centers (80.9%). (See Figure 6.)

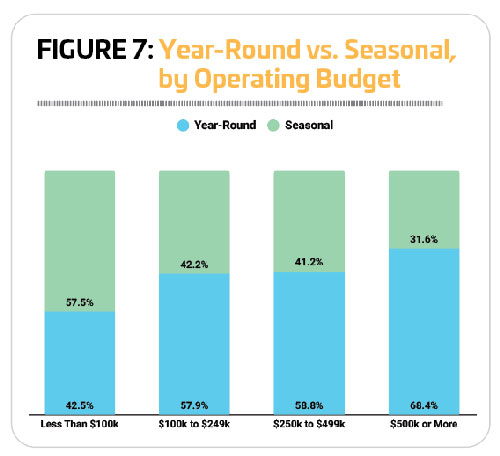

As one might expect, year-round operations tended to be associated with higher average operating costs. Some 68.4% of respondents whose average operating costs in 2023 were $500,000 or more said they had year-round operations. That number falls to 58.8% for respondents with operating costs between $250,000 and $499,999, and to 57.9% for respondents with operating costs between $100,000 and $249,999. On the other hand, a majority (57.5%) of respondents with an average operating cost in 2023 of less than $100,000 said their operations were seasonal. (See Figure 7.)

For those facilities that do operate seasonally, the longstanding tradition of Memorial Day weekend pool openings and Labor Day pool closings continues to hold. Some 57.6% of respondents with seasonal operations said their season begins in May, with another 34.2% opening their season in June. At the other end of the season, 57.6% of respondents with seasonal operations close their aquatic season for the year in September, with another 31.6% ending their season in August.

For those facilities that do operate seasonally, the longstanding tradition of Memorial Day weekend pool openings and Labor Day pool closings continues to hold. Some 57.6% of respondents with seasonal operations said their season begins in May, with another 34.2% opening their season in June. At the other end of the season, 57.6% of respondents with seasonal operations close their aquatic season for the year in September, with another 31.6% ending their season in August.

Costs & Construction

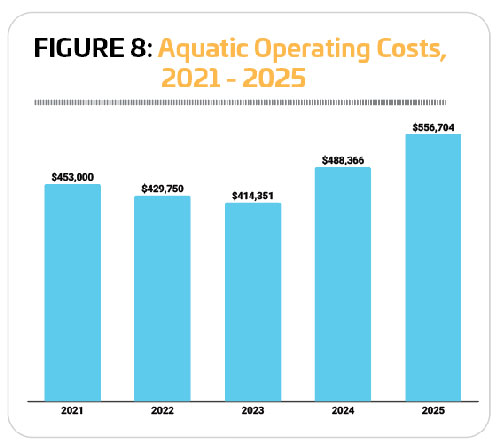

The average operating cost for aquatic facilities in 2023 was $414,351, a 3.6% decrease from 2022, when the average expense was $429,750. Looking forward, aquatic respondents said they expected to spend 34.4% more in 2025 than in 2023, projecting an average operating cost for the year of $556,704. (See Figure 8.)

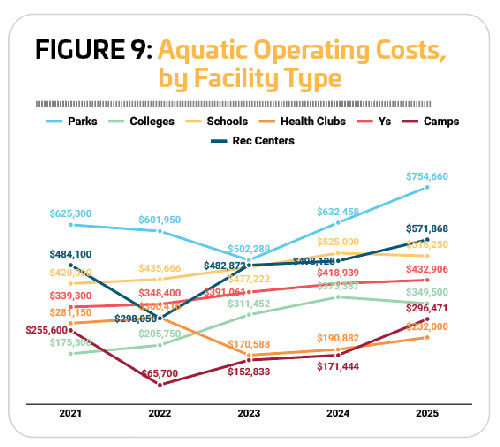

Over the five years covered by this study, respondents from parks consistently reported the highest overall

average operating cost for their aquatic operations. This is likely driven by a number of factors, from parks’ higher number of separate facilities (parks were more likely than others to have more than one pool or splash pad, for example), as well as the concentration of higher-cost facilities like aquatic parks and waterparks among park respondents’ facilities.

In 2023, respondents from parks spent 21.1% more on their aquatic operations than the average for all facility types, with a cost of $502,289. They were followed by rec centers ($482,272), and schools ($477,222). The lowest aquatic operating costs in 2023 were found among respondents from camps, who spent an average of $152,833 on their aquatic operations that year. (See Figure 9.)

In 2023, respondents from parks spent 21.1% more on their aquatic operations than the average for all facility types, with a cost of $502,289. They were followed by rec centers ($482,272), and schools ($477,222). The lowest aquatic operating costs in 2023 were found among respondents from camps, who spent an average of $152,833 on their aquatic operations that year. (See Figure 9.)

While all types of respondents are expecting their average aquatic operating cost to increase from 2023 to 2025, the greatest increases were expected among two of the most disparate spenders. Generally among the respondents with the lowest operating cost, camps are anticipating a 94% increase to their average operating cost, from $152,833 in 2023 to $296,471 in 2025. Parks, consistently the biggest spenders, are expecting their average operating cost for aquatics to increase 50.2%, from $502,289 in 2023 to $754,660 in 2025. Health club respondents were also anticipating a slightly greater increase over these two years, reporting that their operating expenses were expected to rise 36% , from $170,588 in 2023 to $232,000 in 2025.

Smaller increases were expected among respondents from rec centers (up 18.4%, from $482,872 in 2023 to $571,868 in 2025), colleges (up 12.2%, from $311,452 to $349,500), and Ys (up 10.7% from $391,061 to $432,906). The smallest increase was expected by school respondents, who reported that their average aquatic cost would rise 8.2%, from $477,222 in 2023 to $516,250 in 2025.

Smaller increases were expected among respondents from rec centers (up 18.4%, from $482,872 in 2023 to $571,868 in 2025), colleges (up 12.2%, from $311,452 to $349,500), and Ys (up 10.7% from $391,061 to $432,906). The smallest increase was expected by school respondents, who reported that their average aquatic cost would rise 8.2%, from $477,222 in 2023 to $516,250 in 2025.

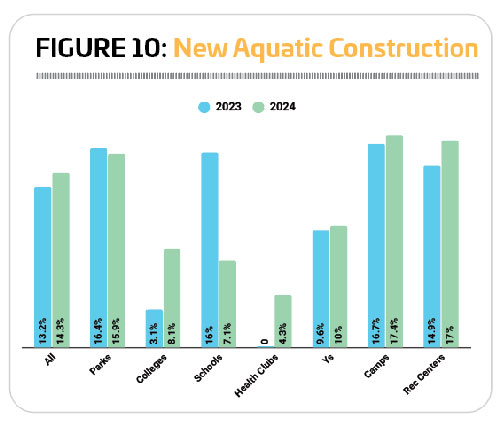

Over the past few years, there has been a slight increase in the number of respondents building new aquatic facilities. In 2022, 12.7% of respondents said they had built a new aquatic facility, and in 2023, 13.2% had done so. In 2024, 14.3% of respondents said they had built a new aquatic facility over the past three years. (See Figure 10.)

Respondents from camps, rec centers and parks were the most likely to report building new aquatic facilities. Some 17.4% of camp respondents, 17% of rec center respondents, and 15.9% of park respondents reported that they had built new aquatic facilities.

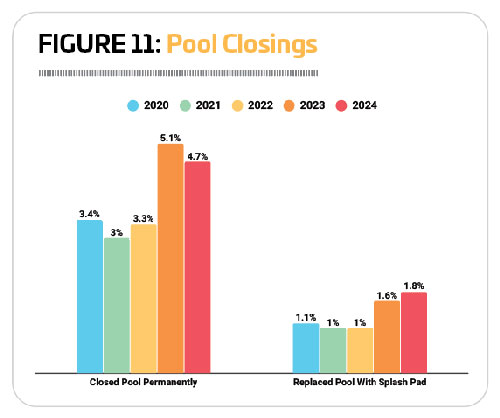

In the past two years’ Aquatic Trends Report, around 5% of respondents reported that they had permanently closed a swimming pool without building a replacement, while slightly less than 2% had replaced a swimming pool with a splash pad. In 2023, 5.1% of respondents had closed a pool permanently, while 1.6% had replaced a pool with a splash pad, and in 2024, 4.7% had closed a pool permanently, while 1.8% had replaced a pool with a splash pad. (See Figure 11.)

In the past two years’ Aquatic Trends Report, around 5% of respondents reported that they had permanently closed a swimming pool without building a replacement, while slightly less than 2% had replaced a swimming pool with a splash pad. In 2023, 5.1% of respondents had closed a pool permanently, while 1.6% had replaced a pool with a splash pad, and in 2024, 4.7% had closed a pool permanently, while 1.8% had replaced a pool with a splash pad. (See Figure 11.)

Respondents from Ys and colleges were the most likely to report that they had permanently closed a swimming pool without building a replacement over the past three years. Some 12.5% of Y respondents said they had done so, up from 6% in last year’s report, and 10.8% of college respondents had permanently closed a swimming pool, down from 14.1% last year.

Only parks, Ys, and rec center respondents had replaced an existing swimming pool with a splash pad, though very few had done so. Some 3% of park respondents, 2.5% of Y respondents, and 2.1% of rec center respondents said they had replaced a swimming pool with a splash pad over the past few years.

Managing Pool Resources

Aquatic facilities require many resources for managing water to ensure it stays clean and free from infectious diseases, as well as clear to ensure lifeguards can see swimmers in trouble. We asked respondents about the various types of systems they rely on to ensure proper water chemistry at their facilities, including filtration, secondary disinfection, and automation tools.

Aquatic facilities require many resources for managing water to ensure it stays clean and free from infectious diseases, as well as clear to ensure lifeguards can see swimmers in trouble. We asked respondents about the various types of systems they rely on to ensure proper water chemistry at their facilities, including filtration, secondary disinfection, and automation tools.

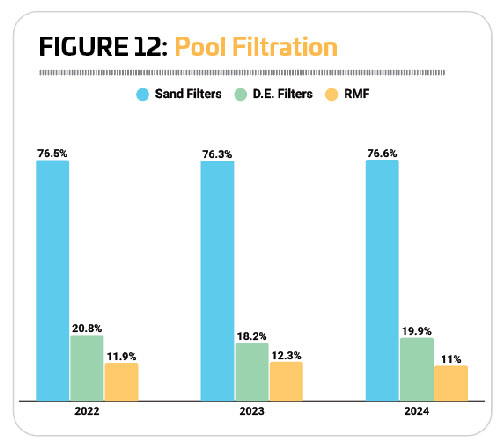

The types of filtration systems aquatic facility operators rely on have remained relatively constant over the past few years, with sand filters maintaining the dominant position. In 2024, more than three-quarters (76.6%) of respondents said they used sand filters, virtually unchanged from 2023 (76.3%) and 2022 (76.5%). D.E., or diatomaceous earth, filters have been used by around one-fifth of respondents in 2022 (20.8%), 2023 (18.2%), and 2024 (19.9%). Finally, regenerative media filters (RMFs) were used by 11% of respondents in 2024, representing very little change from 2023 (12.3%), and 2022 (11.9%). (See Figure 12.)

A majority (82.8%) of respondents reported that they currently have chlorination systems at their facilities, down slightly from 83.3% in 2023, and 84.6% in 2022. Another 11.8% said they rely on bromination systems, up from 11% in 2023, and 7.8% in 2022. Some 43.3% said they currently use a tablet chlorination system, up from 39.4% in 2023 and 38.4% in 2022; and 8.9% are using salt chlorine generators, up from 7.9% in 2023, and 3% in 2022.

A majority (82.8%) of respondents reported that they currently have chlorination systems at their facilities, down slightly from 83.3% in 2023, and 84.6% in 2022. Another 11.8% said they rely on bromination systems, up from 11% in 2023, and 7.8% in 2022. Some 43.3% said they currently use a tablet chlorination system, up from 39.4% in 2023 and 38.4% in 2022; and 8.9% are using salt chlorine generators, up from 7.9% in 2023, and 3% in 2022.

The Model Aquatic Health Code (MAHC), a set of standards established by the Centers for Disease Control and Prevention in cooperation with industry professionals and experts, recommends installing secondary disinfection systems in commercial aquatic facilities. These systems, including UV, AOP, and ozone systems, provide extra protection for swimmers by helping disable chlorine-resistant pathogens in the water. After a drop in last year’s report, the number of respondents who report that they use secondary disinfection systems increased again in 2024, to 42.5%. This is up from 41.7% in 2022, and 35.2% in 2021.

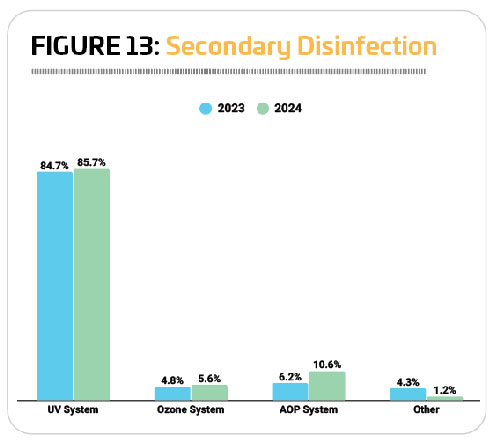

UV systems are the dominant form of secondary disinfection used in aquatic facilities. Some 85.7% of respondents said they rely on UV systems, up slightly from 84.7% in 2023. Another 10.6% said they are using AOP, or advanced oxidation process, systems, up 6.2%. Ozone systems are the choice of 5.6% of respondents, up slightly from 4.8%. (Note: Some respondents relied on more than one type of secondary disinfection system.) (See Figure 13.)

UV systems are the dominant form of secondary disinfection used in aquatic facilities. Some 85.7% of respondents said they rely on UV systems, up slightly from 84.7% in 2023. Another 10.6% said they are using AOP, or advanced oxidation process, systems, up 6.2%. Ozone systems are the choice of 5.6% of respondents, up slightly from 4.8%. (Note: Some respondents relied on more than one type of secondary disinfection system.) (See Figure 13.)

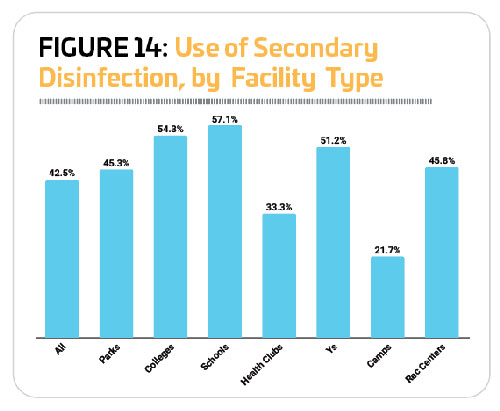

More than half of respondents from schools (57.1%), colleges (54.3%), and Ys (51.2%) said they currently use secondary forms of disinfection. Camps (21.7%), and health clubs (33.3%) were the least likely to do so. (See Figure 14.)

Respondents with higher annual aquatic operating budgets were much more likely to report that they use secondary disinfection at their facilities. Around two-thirds (66.3%) of respondents with operating costs of at least $500,000 a year said they currently use secondary disinfection. This number falls to 46.2% for those whose costs are between $250,000 and $499,999, and 39.1% for those with costs between $100,000 and $249,999. Respondents whose pool operating budgets are less than $100,000 a year were the least likely to use secondary disinfection, with a little more than a quarter (28%) indicating they do so.

Secondary disinfection systems not only help rid the water of chlorine-resistant pathogens, they also can help address problems with chloramines—a type of combined chlorine that forms in the water and can off-gas into the air above the water. Chloramines are known to cause irritation to skin, eyes, and respiratory tract, and also can contribute to the corrosion of metals around the facility, including in air handling systems, according to the CDC. This is obviously a much bigger problem for indoor facilities, where chloramines may linger without well-designed ventilation systems. Thus, it comes as no surprise that respondents who only have indoor swimming pools were almost twice as likely to use secondary disinfection as those with outdoor-only swimming pools. Some 51.9% of those with indoor pools only said they used secondary disinfection, compared with 26.9% of those with outdoor pools only.

Secondary disinfection systems not only help rid the water of chlorine-resistant pathogens, they also can help address problems with chloramines—a type of combined chlorine that forms in the water and can off-gas into the air above the water. Chloramines are known to cause irritation to skin, eyes, and respiratory tract, and also can contribute to the corrosion of metals around the facility, including in air handling systems, according to the CDC. This is obviously a much bigger problem for indoor facilities, where chloramines may linger without well-designed ventilation systems. Thus, it comes as no surprise that respondents who only have indoor swimming pools were almost twice as likely to use secondary disinfection as those with outdoor-only swimming pools. Some 51.9% of those with indoor pools only said they used secondary disinfection, compared with 26.9% of those with outdoor pools only.

Looking forward, 18% of respondents said they had plans to add new systems or update existing systems at their aquatic facilities over the next few years, up just slightly from 16.5% in 2023. Respondents from rec centers (27.7%), Ys (24.4%), and health clubs (19%) were the most likely to have such plans.

The most commonly planned upgrade to pool water treatment systems was UV, with 46.3% of those who had plans for upgrades indicating they would add UV systems, similar to last year’s report, when 45.6% had such plans. Another 31.3% said they would be adding sand filters.

The most commonly planned upgrade to pool water treatment systems was UV, with 46.3% of those who had plans for upgrades indicating they would add UV systems, similar to last year’s report, when 45.6% had such plans. Another 31.3% said they would be adding sand filters.

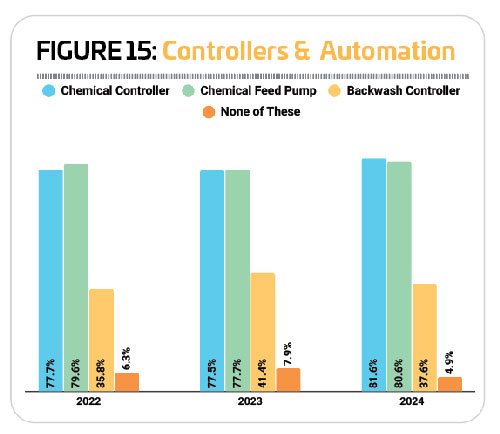

Automation systems are a helpful tool for managing water balance, helping to maintain a regular stream of chlorine or other pool chemicals, while providing alerts to facility managers. Just 4.9% of respondents in 2024 said they were not using any type of controller on their pool. Some 81.6% of respondents were using a chemical controller, 80.6% were using chemical feed pumps, and 37.6% were using backwash controllers. (See Figure 15.)

Since 2019, the number of respondents who report that they have deployed strategies and tools to conserve resources at their facilities has fallen. In 2019, 71% of respondents said they were conserving resources, but in 2024, just 47.3% of respondents said they were conserving resources at their facilities. More than one-third (34.8%) said they are conserving pool chemicals at their facilities, up slightly from 33.3% in 2023. Nearly three out of 10 respondents (29.1%) said they aimed to conserve energy at their facilities, representing virtually no change from 29.5% in 2023. Finally, more than a quarter (27.6%) of respondents said they aim to conserve water at their facilities, up slightly from 26.7%.

Respondents from schools were by far the most likely to report that they currently have strategies and systems in place to conserve water, energy or chemicals at their facilities. Some 84.6% of school respondents said they conserve resources, up from 63.6% in 2023. They were followed by college respondents, 54.8% of whom said they aim to conserve resources at their facilities. Less than half of respondents from health clubs (36.4%), camps (36.8%), Ys (37.5%), parks (46.1%), and rec centers (48.8%) said they have resource-conservation measures in place.

Respondents from schools were by far the most likely to report that they currently have strategies and systems in place to conserve water, energy or chemicals at their facilities. Some 84.6% of school respondents said they conserve resources, up from 63.6% in 2023. They were followed by college respondents, 54.8% of whom said they aim to conserve resources at their facilities. Less than half of respondents from health clubs (36.4%), camps (36.8%), Ys (37.5%), parks (46.1%), and rec centers (48.8%) said they have resource-conservation measures in place.

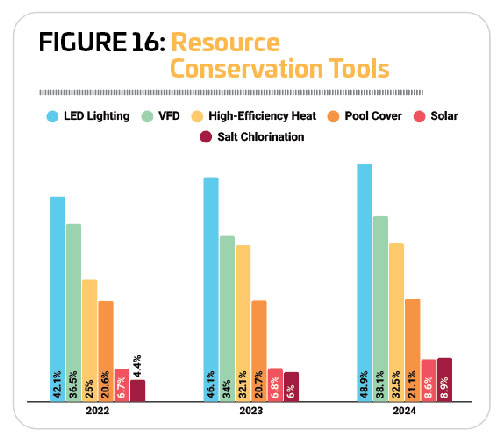

While fewer respondents might be seeking to conserve energy, chemicals and water at their facilities, some of the specific tools that can help with this task have seen growth in use over the past several years. LED lighting, used by 42.1% of respondents in 2022, was used by 48.9% in 2024. The use of high-efficiency heaters grew from 25% of respondents in 2022 to 32.5% in 2024. And the use of salt chlorination doubled, with 4.4% of respondents relying on it in 2022, and 8.9% using it in 2024. (See Figure 16.)

Aquatic Facility Components

While the pools of the past might have simply been rectangular bodies of shallow and deep water, with not much else to provide entertainment or exercise, these days there are all kinds of ways to outfit an aquatic facility to bring more recreational value, as well as sports, fitness and other opportunities to the water.

The most common components found at respondents’ aquatic facilities in 2024 include: lifeguard stands (82% of respondents have lifeguard stands), lane lines (77.7%), pool lifts or other accessibility equipment (69.6%), diving boards (53.5%), and pool exercise equipment (51.1%). But there’s a wide variety of other component types that can be found in aquatic facilities, helping to outfit the pool for competitive or sporting events, recreation, fitness, therapeutic uses and more. Here’s a list of pool components and deck equipment found among respondents’ facilities:

- Lifeguard Stands (82%)

- Lane Lines (77.7%)

- Pool Lifts or Other Accessibility Equipment (69.6%)

- Diving Boards (53.5%)

- Pool Exercise Equipment (51.1%)

- Starting Platforms (48.7%)

- Shade Structures (47.3%)

- Pool Slides (46.2%)

- Zero-Depth Entry (42.7%)

- Water Basketball Equipment (35.2%)

- Scoreboards (27.2%)

- Water Playgrounds (21.8%)

- Water Polo Equipment (21%)

- Pool Blankets or Covers (20.7%)

- Teaching Platforms (19.1%)

- Water Volleyball Equipment (17.2%)

- Pool Inflatables (16.9%)

- Swim Platforms (15.3%)

- Diving Platforms (14%)

- Lazy Rivers (13.7%)

- Swim Walls or Pool Bulkheads (11.8%)

- Poolside Cabanas (11.3%)

- Poolside Climbing Walls (10.5%)

- Lily Pads/Water Walks (7.3%)

- Pool Obstacle/Ninja Courses (4.3%)

- Underwater Treadmills or Bikes (4%)

- Wave Pools (3.2%)

- River Raft Rides (1.9%)

- Water Coasters (0.8%)

- Surf Machines (0.5%)

Items that saw an increase of at least three percentage points between 2023 and 2024 include: diving boards (up 5.6 percentage points), pool lifts and accessibility equipment (up 3.4), shade structures (up 3.4), and water playgrounds (up 3.1).

Items that saw an increase of at least three percentage points between 2023 and 2024 include: diving boards (up 5.6 percentage points), pool lifts and accessibility equipment (up 3.4), shade structures (up 3.4), and water playgrounds (up 3.1).

Respondents from parks were more likely than others to include shade structures, pool slides, zero-depth entry, water playgrounds, poolside cabanas, poolside climbing walls, river raft rides, and surf machines.

College respondents were the most likely to include diving platforms, and swim walls or pool bulkheads.

School respondents were more likely than others to include lifeguard stands, lane lines, diving boards, starting platforms, water basketball equipment, scoreboards, water polo equipment, teaching platforms, water volleyball equipment, and swim platforms.

Health club respondents were the most likely to include underwater treadmills or bikes.

Respondents from Ys were the most likely to include pool lifts and other accessibility equipment, and lily pads or water walks.

Rec centers were the most likely to include pool exercise equipment, pool blankets or covers, pool inflatables, lazy rivers, pool obstacle/ninja courses, wave pools, and water coasters.

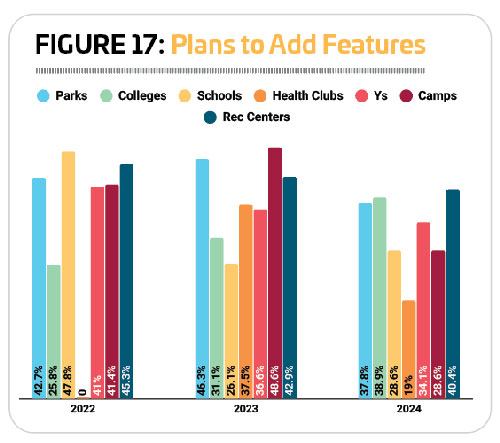

Respondents in 2024 were less likely to report that they had plans to add features, equipment and components to their facilities over the next few years. Some 36.8% of respondents said they had such plans, down from 41.8% in 2023 and 40.2% in 2022.

Respondents from rec centers (40.4%), colleges (38.9%), and parks (37.8%) were the most likely to be planning to add features and components to their facilities, while those from health clubs (19%) were the least likely to have such plans. (See Figure 17.)

The 10 most commonly planned additions at aquatic facilities in 2024 include:

1. Shade structures (planned by 27% of those who will be adding features, down from 30.7% in 2023)

2. Pool slides (21.2%, up from 13.6%))

3. Poolside climbing walls (20.4%, down from 24.1%)

4. Poolside cabanas (20.4%, down from 21.5%)

5. Pool obstacle/ninja courses (19.7%, down from 20.2%)

6. Teaching platforms (17.5%, up from 15.8%)

7. Pool lifts or accessibility equipment

(16.8%, up from 15.4%)

8. Water basketball equipment (16.1%, up from 12.3%)

9. Pool inflatables (15.3%, down from 16.7%)

10. Pool blankets or covers (15.3%, up from 9.2%)

School respondents were more likely than others to be planning to add lifeguard stands, and swim walls or pool bulkheads.

Respondents from health clubs were the most likely to be planning to add pool exercise equipment.

Respondents from Ys were more likely than others to be planning to add pool slides, poolside climbing walls, pool obstacle/ninja courses, pool inflatables, water volleyball equipment, lily pads or water walks, diving platforms, lazy rivers, water polo equipment, river raft rides, surf machines, diving boards, scoreboards, and wave pools.

Camp respondents were the most likely to be planning to add shade structures.

Finally, rec center respondents were more likely than others to be planning to add poolside cabanas, teaching platforms, pool lifts or other accessibility equipment, water basketball equipment, pool blankets or covers, lane lines, underwater treadmills or bikes, water playgrounds, zero-depth entry, starting platforms, water coasters, and swim platforms.

Aquatic Programs

While not all aquatic facilities have formal programming, the vast majority of respondents to the survey—96%—said their facilities do currently offer programming of some kind. This number has held relatively steady over the past few years, with 96.9% of respondents in 2023 and 97.5% of respondents in 2022 indicating their facilities hosted aquatic programs.

A full 100% of respondents from colleges and universities, schools, health clubs, and Ys said they currently offer aquatic programs at their facilities. And more than nine out of 10 respondents from parks (96.8%), camps (95.2%), and rec centers (93.6%) currently provide aquatic programs at their facilities.

As usual, the most common types of programs include learn-to-swim programs, leisure swim time, lifeguard training, and lap swimming. Here is a list of the programs covered by the survey, and their prevalence among respondents’ offerings:

- Learn-to-Swim Programs (81.5%)

- Leisure Swim Time (80.9%)

- Lifeguard Training (78%)

- Lap Swim Time (75.3%)

- Birthday Parties (66.9%)

- Special Events (62.6%)

- Aquatic Aerobics (61.6%)

- Water Safety Training (58.6%)

- Youth Swim Teams (57.5%)

- Swim Meets & Other Competitions (51.1%)

- Programs for Those With Physical Disabilities (36%)

- School Swim Teams (34.9%)

- Water Walking (34.4%)

- Programs for Those With Developmental Disabilities (33.6%)

- Dive-In Movies (25.3%)

- Aqua-Yoga & Other Balance Programs (23.1%)

- Diving Programs & Teams (22.6%)

- Adult Swim Teams (21.2%)

- Aqua-Therapy (19.6%)

- Water Polo (14.5%)

- Doggie Dips (12.4%)

- Collegiate Swim Teams (8.9%)

- Ninja Competitions (0.5%)

Programs that saw an increase of at least three percentage points from 2023 to 2024 include: birthday parties (up 6.2 percentage points), and diving programs and teams (up 3.2).

Given the Y’s mission to reach people with swim lessons and water safety, it’s no surprise that Ys are the most likely to offer these—and many other—types of aquatic programs. Ys were the most likely to include learn-to-swim programs, leisure swim time, lifeguard training, aquatic aerobics, water safety training, programs for those with physical disabilities, water walking, programs for those with developmental disabilities, aqua-yoga and other balance programs, and adult swim teams.

School respondents were more likely than others to include youth swim teams, swim meets and other types of competition, school swim teams, diving programs and teams, and water polo programs.

School respondents were more likely than others to include youth swim teams, swim meets and other types of competition, school swim teams, diving programs and teams, and water polo programs.

Health club respondents were the most likely to include birthday parties, and aquatic therapy.

Respondents from rec centers were more likely than respondents from other types of facilities to host special events.

Respondents from colleges and universities were the most likely to host dive-in movies, and collegiate swim teams.

Park respondents were the most likely to include doggie dips, and ninja competitions.

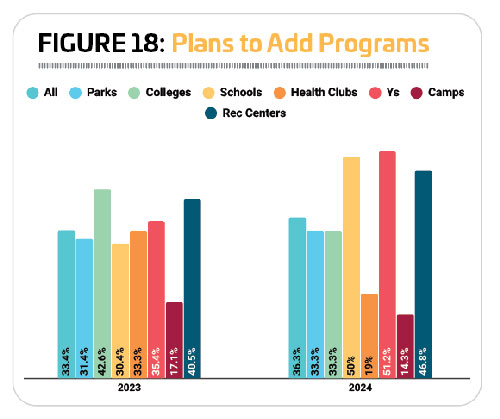

More than one-third (36.3%) of respondents in 2024 said that they had plans to add aquatic programs at their facilities over the next three years. This is up from 2023, when 33.4% had such plans, and 2022 (34.6%).

Respondents from Ys (51.2%), schools (50%), and rec centers (46.8%) were the most likely to report that they had plans to add aquatic programs to their lineup over the next few years. One-third (33.3%) of respondents from parks and colleges had plans to add programs. Health club and camp respondents were the least likely to be planning to add aquatic programs. (See Figure 18.)

The 10 most commonly planned program additions include:

1. Programs for those with physical disabilities

(planned by 30.4% of those who will be adding programs, down from 31.3% in 2023)

2. Dive-in movies (29.6%, up from 23.6%)

3. Programs for those with developmental disabilities

(28.1%, virtually unchanged from 28.6%)

4. Aquatic aerobics (27.4%, up from 20.3%)

5. Aqua-yoga and other balance programs

(25.9%, virtually unchanged from 25.3%)

6. Aquatic therapy (23.7%, up from 22.5%)

7. Special events (18.5%, down from 19.8%)

8. Youth swim teams (14.8%, down from 16.5%)

9. Water safety training (14.8%, down from 16.5%)

10. Ninja competitions (14.8%, up from 8.8%)

The value of swimming lessons—for all ages—has been well established. Drowning continues to be the leading cause of unintentional death for children between 1 and 4 years old, and the second leading cause for those younger than 14. Research has shown that a single month in a formal learn-to-swim program will reduce the risk of drowning by 88%. Organizations across the country, from The USA Swimming Foundation and U.S. Masters Swimming to the Association of Aquatic Professionals and the Pool & Hot Tub Alliance, provide support for learn-to-swim programs every year, helping further aquatic facilities’ mission—and help more people enjoy a lifetime of aquatic fun, sport and exercise.

The value of swimming lessons—for all ages—has been well established. Drowning continues to be the leading cause of unintentional death for children between 1 and 4 years old, and the second leading cause for those younger than 14. Research has shown that a single month in a formal learn-to-swim program will reduce the risk of drowning by 88%. Organizations across the country, from The USA Swimming Foundation and U.S. Masters Swimming to the Association of Aquatic Professionals and the Pool & Hot Tub Alliance, provide support for learn-to-swim programs every year, helping further aquatic facilities’ mission—and help more people enjoy a lifetime of aquatic fun, sport and exercise.

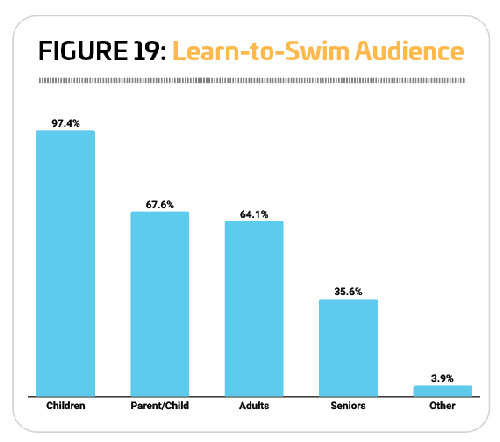

We asked the 81.5% of Aquatic Trends Survey respondents who offer swim lessons to tell us more about these programs, including the audience they primarily reach. The vast majority—97.4%—of those who currently provide learn-to-swim programs said they offer programs for children 17 and younger, up from 94.7% in 2023 and 93.5% in 2022. Another two-thirds (67.6%) said they have swimming lessons designed for parents or caregivers and their babies or toddlers, such as mommy (or daddy) and me classes, down from 74.8% in 2023. Nearly two-thirds (64.1%) provide swim lessons for adults, down from 66.9% in 2023, and 35.6% said they offer learn-to-swim specifically for seniors, down from 39.7% in 2023. Another 3.9% of respondents offering learn-to-swim programs called out “other” audiences for their programs, including adaptive programs and programs for those on the autism spectrum. (See Figure 19.)

There are a number of barriers that can prevent people from learning to swim, from socioeconomic status, community (which might not have access to an aquatic facility), and even whether their parents learned to swim or not. A study from the USA Swimming Foundation and the University of Memphis found that there’s just a 13% chance that a child will learn how to swim if their parent doesn’t know how to swim. Fear can also have an influence, with 46% of American adults afraid of deep water in swimming pools, according to a Gallup Poll. Some aquatic facilities have formed outreach programs or offer programs specifically designed to help overcome these barriers to swimming.

There are a number of barriers that can prevent people from learning to swim, from socioeconomic status, community (which might not have access to an aquatic facility), and even whether their parents learned to swim or not. A study from the USA Swimming Foundation and the University of Memphis found that there’s just a 13% chance that a child will learn how to swim if their parent doesn’t know how to swim. Fear can also have an influence, with 46% of American adults afraid of deep water in swimming pools, according to a Gallup Poll. Some aquatic facilities have formed outreach programs or offer programs specifically designed to help overcome these barriers to swimming.

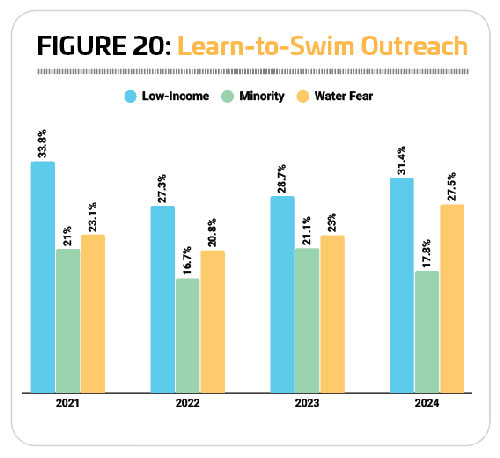

In 2024, some 31.4% of respondents who provide swim lessons said they were involved in outreach to low-income communities, up from 28.7% in 2023. A more substantial increase was seen in respondents who provide outreach and programs specifically for those who have a fear of the water—from 23% in 2023 to 27.5% in 2024. Another 17.8% of respondents with swim lesson programs said they were involved in minority outreach, down from 21.1% in 2023. (See Figure 20.)

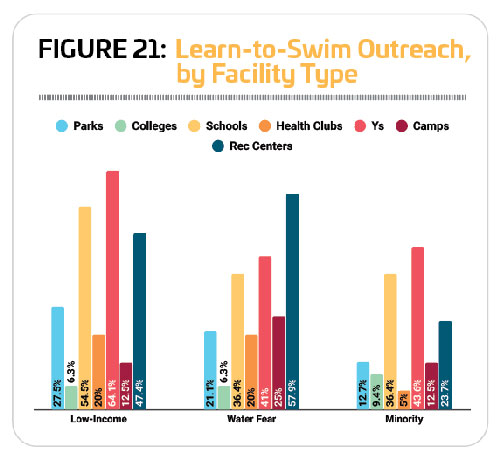

While Ys and schools dominated low-income and minority outreach programs, rec centers were the most likely to cater to people with a fear of the water. Some 64.1% of Y respondents and 54.5% of school respondents said they were involved in outreach to low-income communities, while 43.6% of Y respondents and 36.4% of school respondents were involved in outreach to minorities. Well over half (57.9%) of rec center respondents said they were involved in programs to help people overcome their fear of the water. They were followed by Ys, where 41% of respondents were involved in such programs. (See Figure 21.)

While Ys and schools dominated low-income and minority outreach programs, rec centers were the most likely to cater to people with a fear of the water. Some 64.1% of Y respondents and 54.5% of school respondents said they were involved in outreach to low-income communities, while 43.6% of Y respondents and 36.4% of school respondents were involved in outreach to minorities. Well over half (57.9%) of rec center respondents said they were involved in programs to help people overcome their fear of the water. They were followed by Ys, where 41% of respondents were involved in such programs. (See Figure 21.)

Water Safety & Staff Certifications

Nearly six in 10 respondents (58.6%) offer water safety training, which can provide strong foundational water skills for community members, preventing drowning and other accidents—a mission that goes well beyond the aquatic facility itself to backyard pools, beaches, and any body of water that might present a danger. But within the facility itself, water safety is most often backed up by a staff of well-prepared lifeguards.

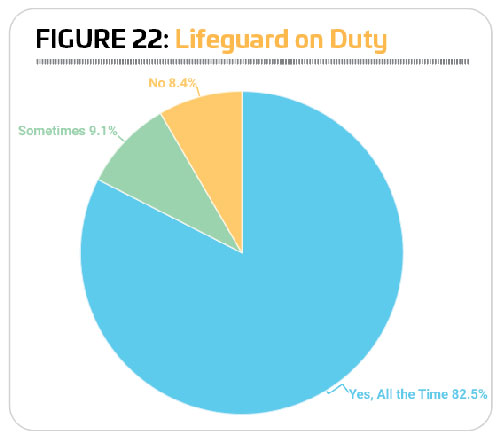

The majority of respondents—91.6%—said that a lifeguard is on duty at least some of the time during their hours of operation, down slightly from 93.7% in 2023. Some 82.5% said a lifeguard is on duty at all times, down from 84.3%, while 9.1% said a lifeguard is on duty during at least some hours of operation, representing virtually no change from 9.4% in 2023. Just 8.4% of respondents said they do not employ lifeguards at their aquatic facilities. (See Figure 22.)

The majority of respondents—91.6%—said that a lifeguard is on duty at least some of the time during their hours of operation, down slightly from 93.7% in 2023. Some 82.5% said a lifeguard is on duty at all times, down from 84.3%, while 9.1% said a lifeguard is on duty during at least some hours of operation, representing virtually no change from 9.4% in 2023. Just 8.4% of respondents said they do not employ lifeguards at their aquatic facilities. (See Figure 22.)

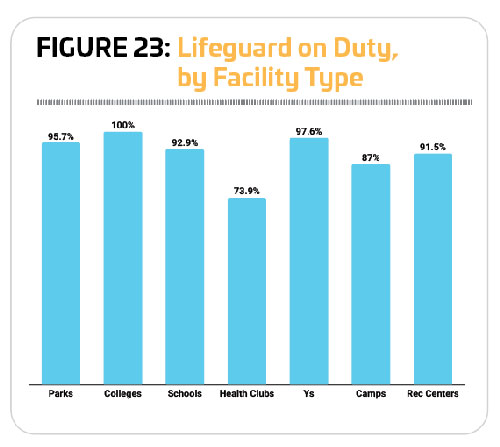

All 100% of respondents from colleges and universities said they have a lifeguard on duty, with 94.6% indicating a lifeguard is always on duty at their aquatic facilities, and 5.4% reporting a lifeguard is on duty at least some of the time. More than nine out of 10 respondents from Ys (97.6%), parks (95.7%), schools (92.9%), and rec centers (91.5%) said a lifeguard is on duty at least some of the time at their facilities, with the vast majority reporting a lifeguard is on duty at all hours when the facility is open. Least likely to have a lifeguard on duty were respondents from health clubs, where 73.9% said they employ lifeguards, though just 39.1% do so during all hours of facility operations. They were followed by camps, with 87% indicating a lifeguard is on duty at their facilities at least some of the time, and 78.3% reporting a lifeguard is on duty during all open hours. (See Figure 23.)

Drowning prevention experts recommend a layered approach. The number-one strategy for protecting swimmers may be to employ well-trained and certified lifeguards, but there are other methods and technologies that can help. Just as UV and AOP systems provide a secondary method of sanitization to chlorination systems, these tools can provide a secondary backup to the lifeguarding staff. The tools most often used to prevent drowning by respondents to the Aquatic Trends Survey include:

Drowning prevention experts recommend a layered approach. The number-one strategy for protecting swimmers may be to employ well-trained and certified lifeguards, but there are other methods and technologies that can help. Just as UV and AOP systems provide a secondary method of sanitization to chlorination systems, these tools can provide a secondary backup to the lifeguarding staff. The tools most often used to prevent drowning by respondents to the Aquatic Trends Survey include:

- Lifeguard on duty: 91.6%, down from 93.7% in 2023.

- Life preservers required for less- skilled swimmers: 45.9%, up from 44%

- Video or other in-pool system for detecting swimmers in trouble: 6.9%, up from 5.8%

- Other: 9%

- None: 4.5%

Some of the “other” methods for protecting swimmers from drowning and injury include: age limits on who can enter the facility, swim tests before allowing children into the deep end of the pool, direct parental supervision requirements, and equipment that provides submersion alerts.

The impact of the COVID-19 pandemic has largely waned over the past few years, and aquatic facilities that saw a dramatic impact on lifeguard training and staffing have gradually recovered lost ground. In 2024, 41.8% of respondents said their facility had been affected by lifeguard staffing shortages. This is down from 53.3% in 2023, and 67.3% in 2022. More than three in 10 (30.8%) of respondents said they had reduced their facility’s hours of operation due to this issue, down from 44.6% in 2023. Another 13.4% said they had shortened their season of operation due to difficulties with lifeguard staffing, representing little change from 13.9% in 2023. And 7.4% said at least one facility remained closed due to lifeguard staffing difficulties, down from 8.5% in 2023.

Respondents from Ys (68.3%) and colleges (56.8%) were the most likely to report that they had difficulty staffing lifeguards in 2024. They were followed by rec centers (47.8%), parks (39.4%), and schools (38.5%). Respondents from Ys (56.1%) and colleges (45.9%) were the most likely to report that they had reduced their operating hours as a result of this difficulty. Park respondents (18.8%) and camp respondents (17.4%) were the most likely to have shortened their seasons. Ys (14.6%) and rec centers (10.9%) were the most likely to report that at least one aquatic facility had remained closed due to difficulties with lifeguard staffing.

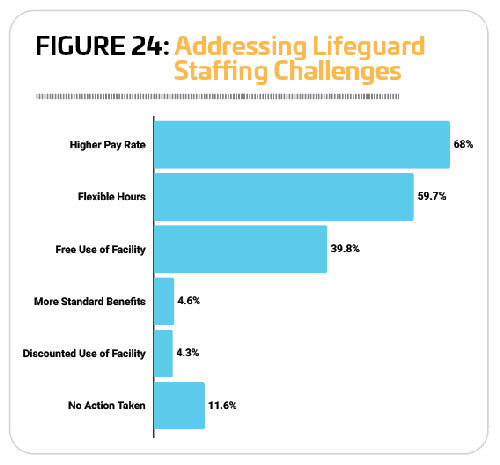

When the initial difficulties with lifeguard staffing became apparent, many facilities adjusted their compensation and benefits packages in order to strengthen their position and attract more people to the job. Nearly seven in 10 (68%) respondents said they had offered a higher rate of pay in order to attract more potential lifeguards, down from 74.2% in 2023, but still higher than 2022, when 66.7% had raised their pay rate. Another 59.7% said they offered flexible hours, up from 58.7% in 2023 and 53.8% in 2022. And 39.8% of respondents said they offered free use of their facilities, down from 42.9% in 2023, but still higher than the 35.2% who did so in 2022. Less common strategies included more standard benefits, such as vacation time, insurance or retirement plans (4.6%), or offering a discounted use of the facility (4.3%). (See Figure 24.)

When the initial difficulties with lifeguard staffing became apparent, many facilities adjusted their compensation and benefits packages in order to strengthen their position and attract more people to the job. Nearly seven in 10 (68%) respondents said they had offered a higher rate of pay in order to attract more potential lifeguards, down from 74.2% in 2023, but still higher than 2022, when 66.7% had raised their pay rate. Another 59.7% said they offered flexible hours, up from 58.7% in 2023 and 53.8% in 2022. And 39.8% of respondents said they offered free use of their facilities, down from 42.9% in 2023, but still higher than the 35.2% who did so in 2022. Less common strategies included more standard benefits, such as vacation time, insurance or retirement plans (4.6%), or offering a discounted use of the facility (4.3%). (See Figure 24.)

Nearly one-fifth (18%) of respondents to this question said they had relied on some “other” method for attracting lifeguarding staff to their facilities. This included a variety of bonuses, including for referrals, or for working to the end of the season, as well as reimbursement for certification, providing free or discounted meals, extending discounts to family members, and expanding the hiring pool by recruiting junior guards, or recruiting seniors to the position. One innovative respondent replied that they were using a “highly automated recruiting process involving emails and text messages”… “built in-house” using existing tools with “limited additional cost”—a strategy that yielded big benefits: “Candidate engagement and conversion has increased more than three times since implementation.”

Just as lifeguards require training and certification to ensure they have the knowledge and skills to protect swimmers at your facility, you need staff who are trained and certified to ensure your facility is in good working order—folks who understand pool chemistry, mechanical equipment, ventilation requirements, water testing, and more. Certifications like the Certified Pool & Spa Operator or Aquatics Facility Operator provide validation of these staff members’ knowledge and capabilities, with continuing education requirements helping to ensure that their skill set is kept up-to-date.

Just as lifeguards require training and certification to ensure they have the knowledge and skills to protect swimmers at your facility, you need staff who are trained and certified to ensure your facility is in good working order—folks who understand pool chemistry, mechanical equipment, ventilation requirements, water testing, and more. Certifications like the Certified Pool & Spa Operator or Aquatics Facility Operator provide validation of these staff members’ knowledge and capabilities, with continuing education requirements helping to ensure that their skill set is kept up-to-date.

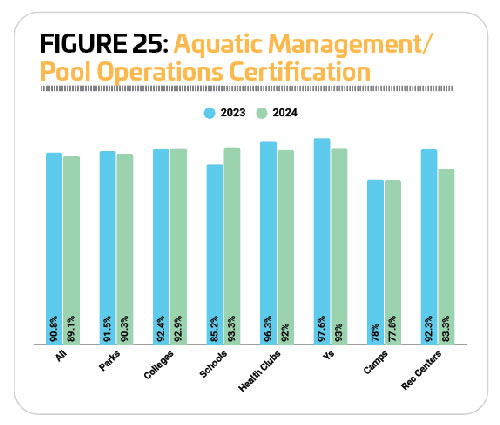

In 2024, 89.1% of respondents said that they or someone at their facility has an aquatic management or pool operations certification. This is down from 90.8% in 2023 and 93.1% in 2022.

Only respondents from schools were more likely to have these types of certification in 2024 (93.3%) than in 2023 (85.2%). For respondents from colleges and camps, the prevalence of these certifications remained relatively unchanged. Rec centers saw the greatest decrease, with 92.3% having the certifications in 2023, and 83.3% having them in 2024. (See Figure 25.) RM